In order to achieve 200 million Yen for investment asset, I need to review my current income status and my work environment.

Based on that, I’d like to consider investment strategy.

In this year, I’m 30’s and close to 40’s. So, I still have time for 50 years until 80’s.

It’ll be more important for me to earn money and how much invest stock by spending 50 years.

In case I consider strategy, I always prepare 2 ways of thinking.

- Top down approach

- Bottom up approach

“Top down approach” is that trying to consider strategy from 80’s as a goal point.

In my case, I need to achieve 200 million Yen until 80’s.

So, From 80’s, I need to create goal back plan 80, 79, 78 … until 30’s.

When I re-allocate asset allocation from what asset to what asset .

Therefore, It’s very difficult for me to predict future economics of world right now, Unfortunately.

Tax rate, Law, world economics, or My life situation, I cannot imagine any future world.

So, I won’t deeply consider the future.

Currently, It’s important for me to precisely understand my current cash flow first, Even if I need to consider “Top down approach”.

*I’ll post article “Top down approch” separately.

Oppositely, I’m trying to consider how to improve my situation and how to achieve the target from current my cash flow by “Bottom up approach”.

Then, I’ll think how to increase monthly income and where to invest.

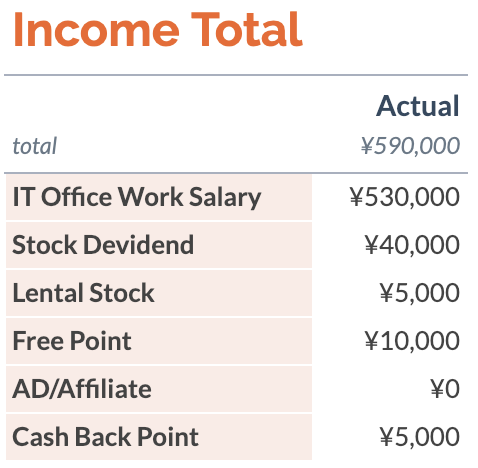

Firstly, I’d like to disclose my monthly income. Let us check it.

Current my main monthly income asset is 530,000 Yen as a IT office work.

As for IT office work, I can keep my salary quality within future around 5 years.

But, I’ll be hard to keep same or high quality of salary after decade.

For now, I have gotten 40,000 Yen by dividend as an income gain and trade as a capital gain.

And, I can also get 5,000 Yen as a lental stock fee, 10,000 Yen as a free point, and 5,000 Yen as a cash back point.

As a total, I can monthly get 590,000 Yen which is without tax.

Based on my monthly income, I’d like to make resolution for this year.

My resolution is that I create new income asset aside from IT office work in order to not persist in office work as an employee.

Until 50’s, I’d like to create my inflow asset allocation office work and another by 50&50.

As a first step for my resolution.

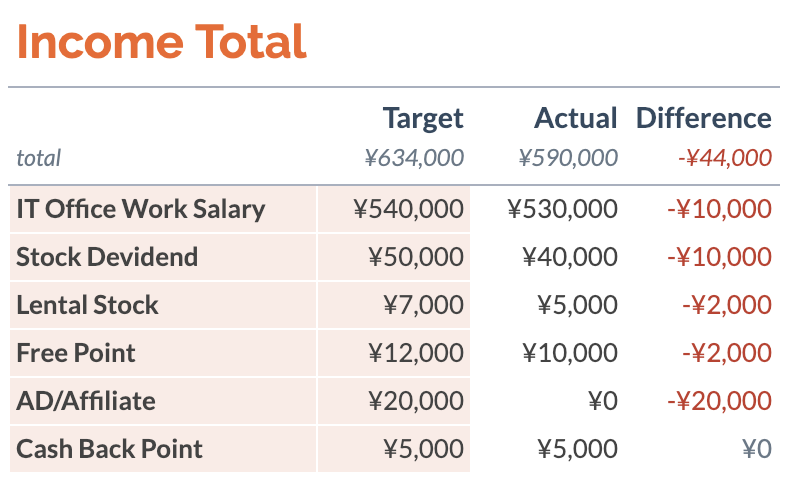

I created this year income allocation as follows…

In this year, I’d like to more focus on stock investment and AD/Affiliate new income development!

Regarding IT office work, I’d like to commit high performance and +5% business growth in this year.

I briefly estimate I can get +10,000 Yen monthly salary.

As for stock investment, I need to invest stock by spending amount of 3.6 million at 3 NISA accounts.

Yearly dividend target is more than 6%, So I hope I could achieve +10,000 Yen monthly income from stock dividend.

Based on that, lent stock also increase +2,000 Yen.

It’s my plan…

If it’ll goodly work my system, I’ll be able to get +44,000 Yen and achieve 634,000 Yen as a total.

But, I don’t know my future. Don’t miss it.

To be continued fighting…